How To Read Your Tax Bill

How to read your tax bill

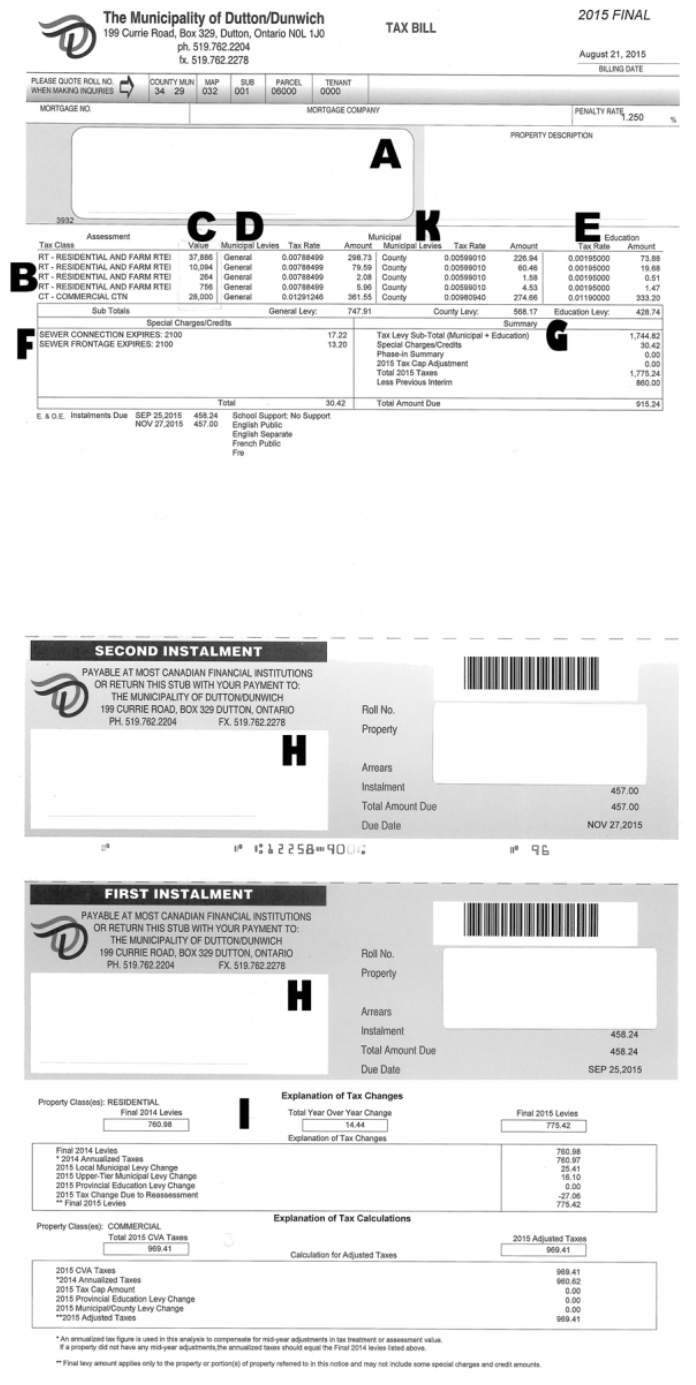

A – Property Identification

This section contains identification information such as municipal tax roll number, mailing address and a legal description of your property.

B - Tax Class

This section lists the classification(s) of your property (i.e., residential, farm, commercial ) and educational support. The tax class codes are explained at the top right of the page. If you have questions about education support, call the Municipal Property Assessment Corporation at 1-866-296-6722.

C - Value

This shows the current value of your property, as assessed by the Municipal Property Assessment Corporation.

D - Municipal Rate Levies

This section provides a detailed breakdown of your property taxes as set by Council. To determine the amount of tax you pay for each service, multiply the tax rate for that service by the assessed “value” for your property.

E - Education Tax

The education tax is set by the provincial government. To determine the amount of education tax you pay, multiply the education tax rate by the assessed “value” of your property.

F- Special Charges

This section lists charges that are specific to your property. Special charges cover a range of services including sewer and water upgrades and other local improvements.

G -Summary

This section lists the subtotals of your tax levy (municipal and education), tax cap and any credits or special charges.

H - Payment Stubs

You need to submit payment stubs along with your payment, when you pay by mail, in person or at a financial institution. If you pay by installments, submit the second stub with payment of the second installment. If you pay through a pre-authorized plan, you do not need to submit either of the stubs.

I - Schedule 2

Schedule 2 pertains to Residential, Farm, Managed Forest or Pipeline property classes. It shows the year over year change in taxes levied, from 2015 to 2016, comprised strictly of the actual taxes, excluding any special charges or credits. It is further broken down by the municipal levy change, education levy change and by any tax change due to reassessments.

K - County Rate Levies

This section provides a detailed breakdown of your property taxes as set by County Council. To determine the amount of tax you pay for each service, multiply the tax rate for that service by the assessed “value” for your property.

Tax Class Codes

CTN Commercial Taxable

CUN Commercial Excess Land

CXN Commercial Vacant Land

EN Exempt

FT* Farmland

ITN Industrial Taxable

IUN Industrial Excess Land

IXN Industrial Vacant Land

MT* Multi-Residential

PTN Pipeline Taxable

RT* Residential

TT* Managed Forest

XTN New Commercial

XUN New Commercial Excess Land

School Support

EP English Public

ES English Separate

FP French Public

FS French Separate

N No Support

Subscribe to this page

Subscribe to this page